Like a bank transfer, but better.

Like a bank transfer, but better.

No % fees. Instant payout.

No % fees. Instant payout.

Taking Client Payments This Week?

Taking Payments This Week?

Free for 3 Days

Plans from £4.99/month (10, 25 or 50 transactions)

Up to 50% cheaper than card fees.

Free for 3 days

Plans from £4.99/month

10, 25 or 50 transactions included

Up to 50% cheaper than card fees

Send a payment link or accept a bank transfer on the spot.

Customers don’t need the app.

Send a payment link or accept a bank transfer on the spot. Customers don’t need the app.

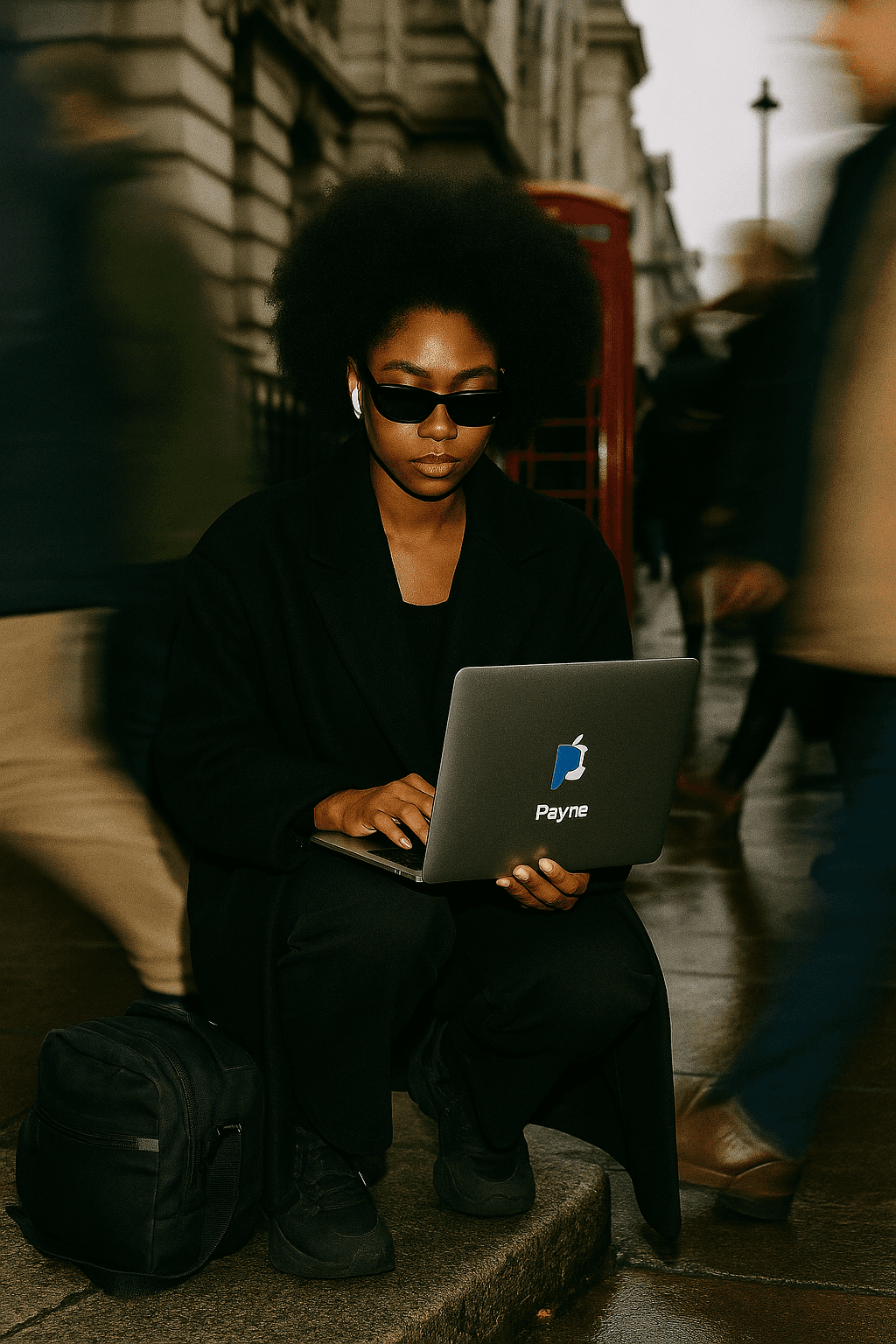

Payme is for UK businesses who’d rather be paid than pending.

Payme is for UK Businesses who’d rather be paid than pending.

Payme is for UK Businesses who’d rather be paid than pending.

Start keeping 100% of what you earn.

Start keeping 100% of what you earn.

Stop sharing your bank details

Send one QR. Customers scan. You get paid. No awkward bank chats. No copy-paste errors.

Stop giving up a cut to get paid

Keep 100% of what you earn. No card machine. No sneaky fees. Just clean, full payments, every time.

Stop chasing customers

Cut the back-and-forth. Clients pay you on the spot, before they even leave. One scan, job done.

Get started in under a minute.

Get started in under a minute.

Available to UK businesses only.

What is Payme?

How do I get paid?

Do customers need the Payme app?

How long does setup take?

What is Payme?

How do I get paid?

Do customers need the Payme app?

How long does setup take?

Get started in under a minute.

Available to UK businesses only.

Built for UK businesses.

Download the app👇🏽

Built for you.

💇🏽 Barber Shops

💇🏽 Barber Shops

More shape-ups, less shake-downs.

More shape-ups, less shake-downs.

🧹 Cleaners

🧹 Cleaners

Wipe away

dirty card fees.

Wipe away

dirty card fees.

💅🏽 Beauticians

💅🏽 Beauticians

Same-day glam, same-second pay.

Same-day glam, same-second pay.

🧑🏽💻 Solopreneurs

🧑🏽💻 Solopreneurs

Less admin.

More income.

Less admin.

More income.

🔧 Tradespeople

🔧 Tradespeople

No hardware needed.

Just a QR code.

No hardware needed.

Just a QR code.

🐩 Pet Services

🐩 Pet Services

Impress clients.

Premium pay.

Impress clients.

Premium pay.

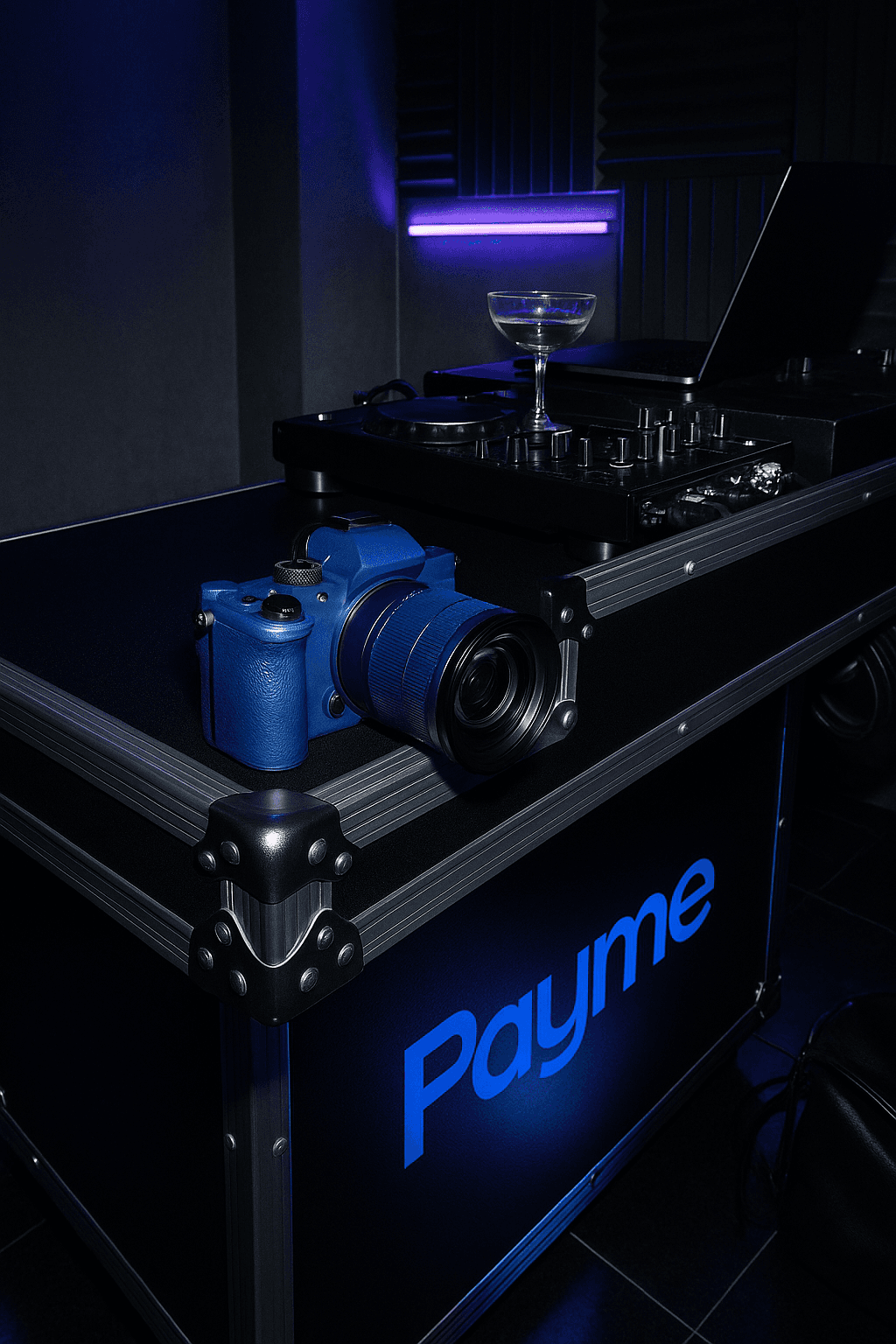

📸 Event Pros

📸 Event Pros

Get paid,

even on the go.

Get paid,

even on the go.

In partnership with Moneyhub, an FCA regulated provider.

In partnership with Moneyhub, an FCA regulated provider.

©2025 Usepayme Limited. All rights reserved. All logos and trademarks are property of their respective owners.

©2025 Usepayme Limited. All rights reserved. All logos and trademarks are property of their respective owners.